Top 5 CRM Tools for Freelancers and Small Businesses

When you have just a few clients, it’s easy to keep track of them in an Excel document. But as your business grows, it becomes harder to track your communication, sales efforts and project progress. That’s where Customer Relationship Management (let’s call it CRM from here on) tools come into play.

Even if you consider yourself a small business, you can benefit from these tools — and it doesn’t have to cost you a fortune (in fact, 3 of them have a free plan).

Almost all of these offer mobile apps and Outlook integration, so consider that covered. In this article I will focus on each product’s unique features.

Key Takeaways

- SalesForce is a leading CRM tool that offers affordable plans and features like contact management, lead and opportunity tracking, and a range of reports. It also allows integration with social media accounts for specific contacts.

- Nimble is a CRM tool that focuses on integrating social accounts and displaying all contact information in one place. It also enables tracking of commercial opportunities within your current social contacts. However, it lacks reporting features.

- Insightly combines CRM with integrated project management. It provides functionalities like task tracking, contact management, and opportunity management. It also allows conversion of closed opportunities directly into projects.

- Zoho CRM is a budget-friendly option with a free 3-user plan. It offers similar functionalities to SalesForce and also includes unique features like competitor tracking for deals and call duration recording. SugarCRM is a downloadable CRM tool that can be hosted by the user, offering privacy and cost benefits. It includes features like account, lead, and opportunity management, as well as a powerful newsletter manager.

The leader: SalesForce

Let’s start by looking at the company that indisputably changed the CRM market, SalesForce. These guys made CRM accessible to practically anyone, with plans starting at just $5 a month for one user.

The “Contact Manager” is their entry plan, and offers some pretty decent CRM features. If you choose the “Group” edition you also get lead and opportunity tracking, compelling features when you’re chasing new clients.

Contacts / Leads

For each contact on your list, you can enter basic information, schedule tasks, view contact history and browse attachments.

You can connect Facebook, Twitter and LinkedIn accounts for the specific contacts and see their social media updates within SalesForce.

You can also keep track of sales opportunities for each contact. These are kept in the opportunities tab, and are automatically attached to the relevant account or lead. This may seem a bit redundant, but it means you can’t easily lose crucial information.

The “Leads” section (in the Group Edition) looks the same as “Contacts”, but allows you to differentiate between current and (hopefully) future customers.

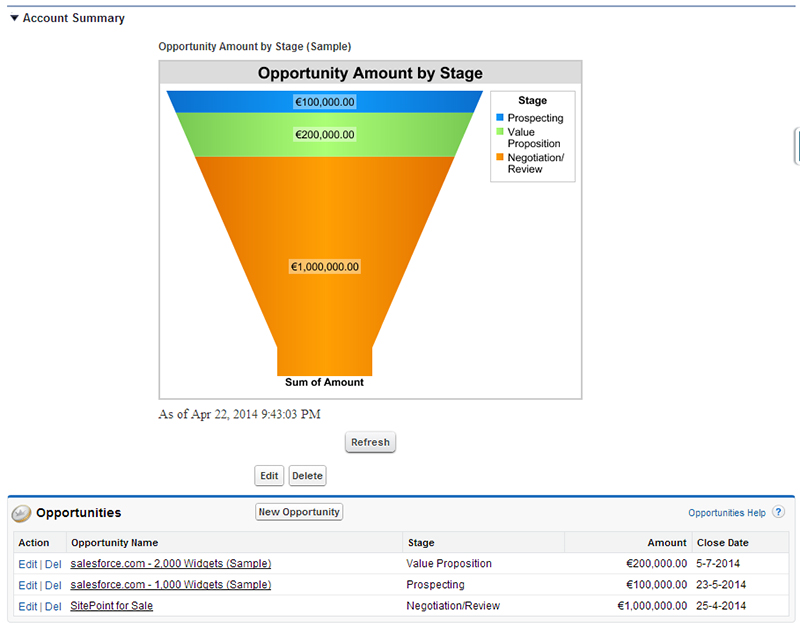

Accounts

The Accounts tab is basically the aggregation of your contacts and opportunities for current customers, with the addition of a visual sales funnel.

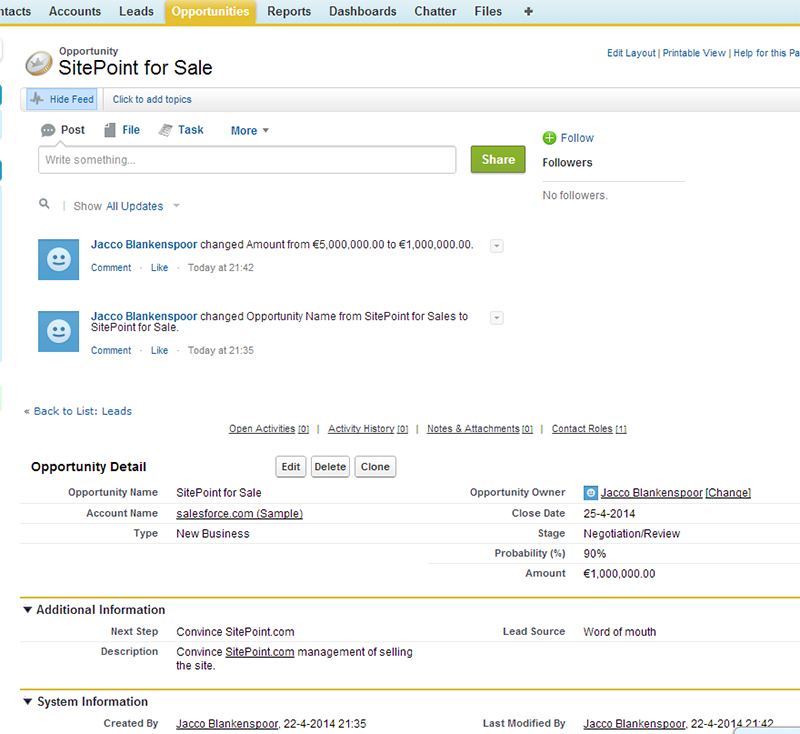

Opportunities (Group Edition)

This is where you keep track of your sales progress. The information your enter here is all linked to the deal itself, for seamless tracking.

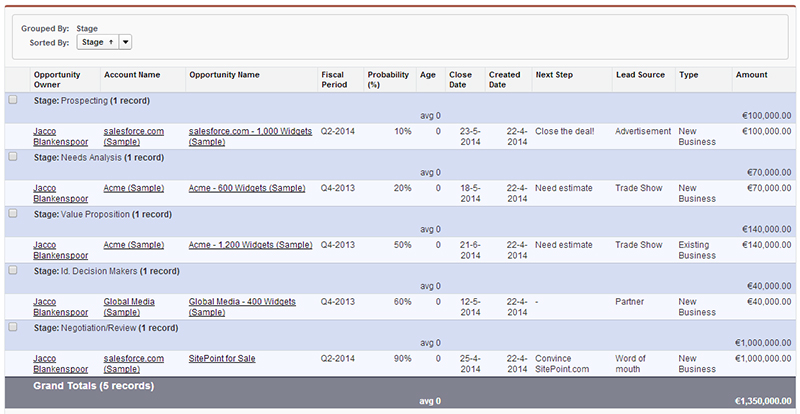

Reports / Dashboard

SalesForce comes with a whole number of reports, which give your very precise insights into the data collected in the above-mentioned sections. You can drill down till you’re sick of it — or until the numbers become meaningless! You can also create custom reports, if you’re after something the standard reports don’t show.

![Salesforce Dashboard]](https://uploads.sitepoint.com/wp-content/uploads/2014/05/1399349028SalesForce-Dashboard.jpg)

But we all know numbers can be a bit boring, so SalesForce also lets you create dashboards. These add a bit of visual interest, but they aren’t as precise as reports. Good if you need to quickly update someone else on your progress, but not great at giving you actionable information.

So Why SalesForce?

SalesForce certainly knows how customer relationship management should be done, and this is a great tool. It works very intuitively — you basically don’t need any help to get started. They really set the standard for CRMs. Now If only the dashboards were a bit more fancy…

SalesForce offers a free 14-day trial.

Now let’s have a look at some other contenders, and find out what makes them unique.

Let’s go social: Nimble

Nimble promises to connect all your contact information in one place, including social accounts, and to display it all in a convenient dashboard. Sound promising, but does it deliver?

NNimble has one paid plan with all of their features for $15 per month per user, with only a few (generous) limits on number of contacts, storage and social network accounts. They also offer a free plan which should be sufficient if you’re starting out.

Nimble has a pretty simple interface, since most of it’s functionality is grouped.

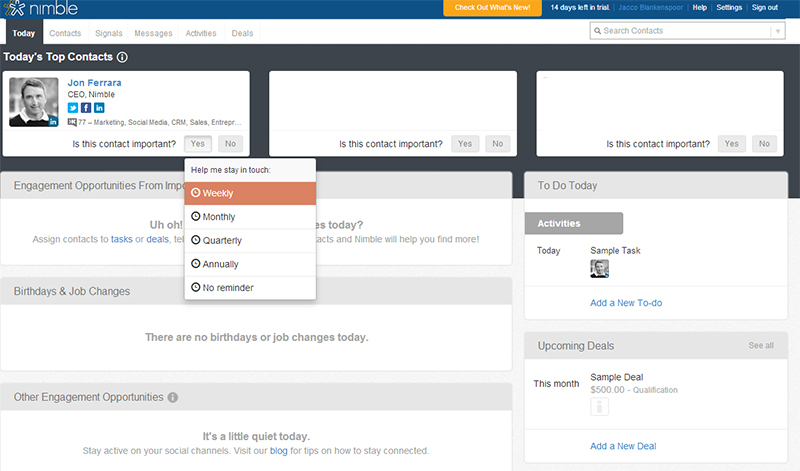

Today

After you sign up, the first step is to connect Facebook, Twitter, Google+, Linkedin, Gmail and Google Apps account (all optional). By doing this you can keep track of any commercial opportunities within your current social contacts.

The “Today” screen also keeps you updated on the most important data.

Contacts

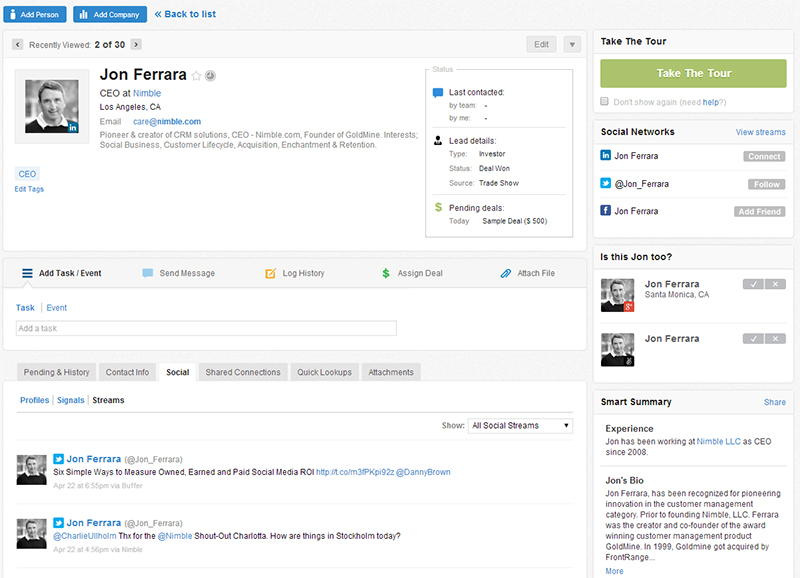

For each new contact you can add their social accounts alongside their regular contact details, even if you’re not connected or you don’t follow them. You can even send them a message on the social network of your choice, as each platform allows.

The contacts panel is also where you define the lead information and assign any deals in progress (on the top right). This is all a bit simplistic compared to SalesForce, and requires you to click through for more details.

Nimble does offer excellent options to display anything you know about your contact in this view, along with information gathered from social networks. I’ve shown a partial list on the right, but the list could become very long.

Signals / Messages / Activities

This is the hub for all social activities. All of the updates on your connected accounts are listed here — it’s like a social media dashboard for all of your contacts. I don’t think my contacts want their information displayed in an article, so I’ve omitted the screenshot!

There’s also a “Signals” function, which helps you identify engagement opportunities (as they call it) like job changes, birthdays, and so on.

In the “Messages” tab the messages you receive on your connected social and email accounts are collected.

In the “Activities” section you will find a basic task manager.

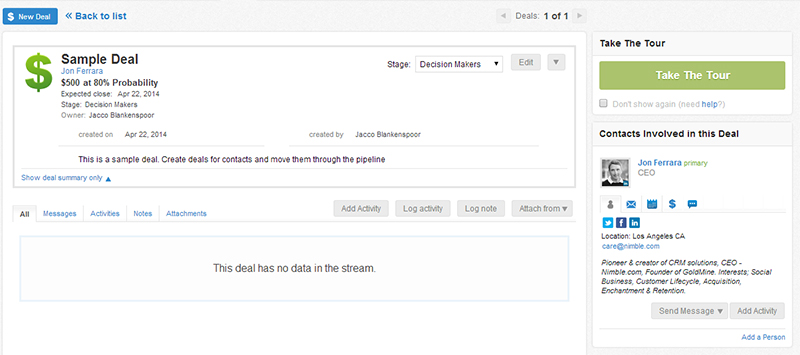

Deals

The “Deals” screen looks (again) a bit simple at first, but when you take a closer look you see it’s actually pretty convenient. It combines all the relevant data from the other sections in one decent overview.

It would be great if you could filter on some metrics, like stage or company. This layout can become overwhelming very quickly.

So why Nimble?

I must say their approach on combining social accounts is well executed. It goes even further than I’ve shown here, since it also has some powerful sending possibilities.

I do think Nimble is better for keeping track of your current customers than for chasing after prospects. Both leads and current customers are thrown into the “Contacts” section, without any options to filter them out. Same goes for deal tracking — no filters there either.

One surprising thing: there is currently no reporting. None! They claim it will be part of a 2014 update, but at least some basic reporting should have already been included.

If you want to go full on social, and don’t need to report on your activities, Nimble is perfect for you.

Nimble offers a free 14-day trial.

CRM + Project management = Insightly

What makes Insightly interesting is its integrated project management, in addition to the CRM functionality.

Insightly offers a limited (but useful) free plan, and a nearly unlimited plan for just $7 a month per user.

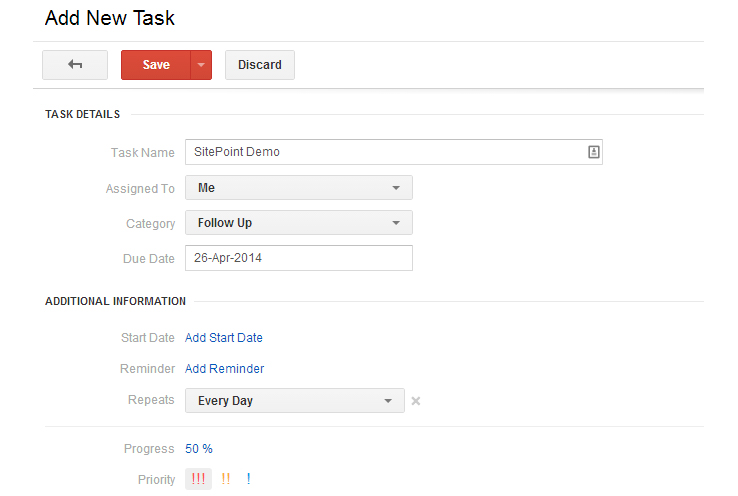

Tasks

The Tasks feature is pretty useful in keeping track of to-dos, including prioritization and related project or opportunity.

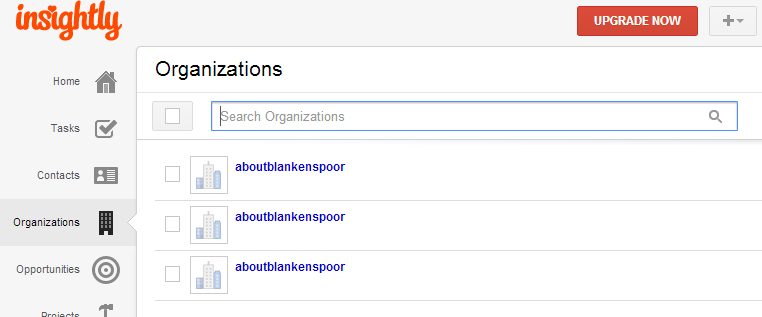

Contacts / Organization

This part needs a little bit of work. Insightly states it can connect a contact’s social media accounts just by using it’s email address, yet it couldn’t find my LinkedIn profile, for example. You can manually add links, but that takes away a bit of the magic.

Also, adding a contact to a specific organization didn’t work so well either. After adding my own company and then trying to add 2 contacts to it, I got this as a result:

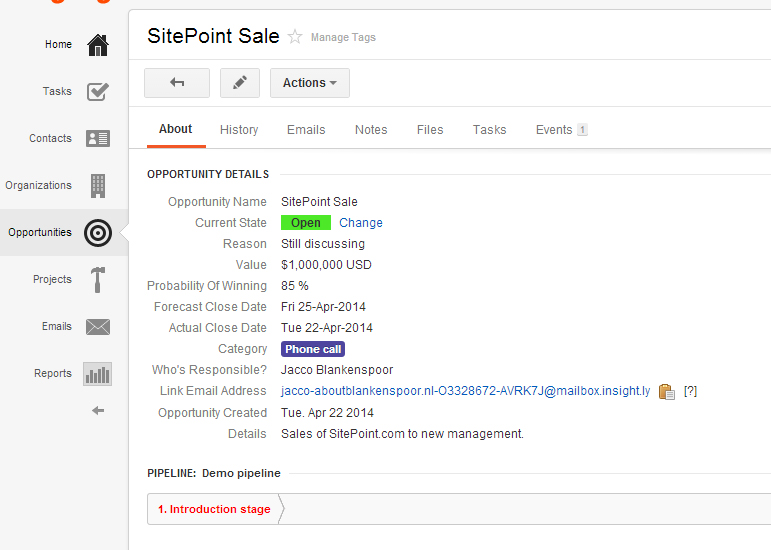

Opportunities

Insightly doesn’t come with a pre-defined set of pipelines and stages, so you’ll have to add these first. It does offer a clean base to start with, and add only relevant details.

It works a bit differently from the other tools we’ve looked at, since for each stage in the sales process you have to define a related task. It allows for enormous flexibility, but does require some work to figure it out and set up properly. In the end you get a pretty convenient overview.

The email address you see in the screenshot can be used to email relevant correspondence, which attaches the message to the Opportunity. Nice!

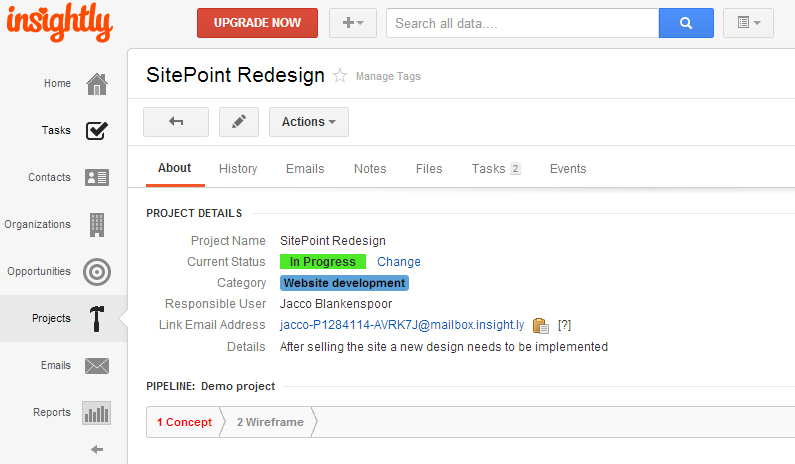

Project

The project management works a lot like the Opportunities, but is much simpler — it doesn’t include projected revenue, for example, assuming that the financials have already been settled. You can convert closed opportunities directly into projects.

Again, you’ll need to define a pipeline with stages and related activities. These activities translate into tasks. These tasks are then added to an Outlook-like calendar, and to the main “Tasks” section.

One great thing about the Projects functionality is that you can share the project’s progress with the person who originally closed the deal. It’s perfect for after-sales support.

So why Insightly?

If you take the time to set up the necessary values for the opportunities and projects, Insightly is a great product. If you want integrated project management this would be your best choice, since it’s really well worked out. It offers decent reporting, too.

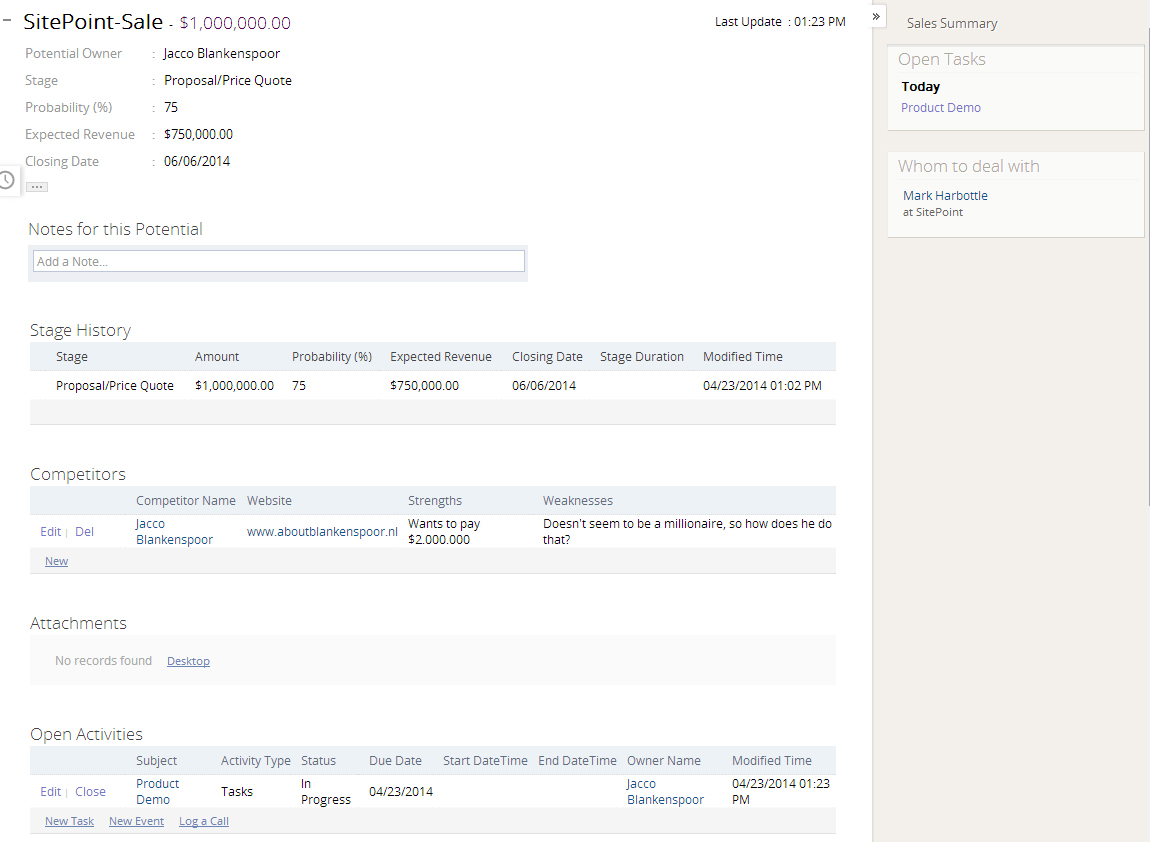

Need a free option? Zoho CRM

Zoho CRM has a whole range of productivity tools, and most of them come with a free 3-user plan with more than enough features.

Zoho is much inspired by SalesForce when it comes to layout and functionality of the detail screens (like opportunity details). There is some difference in naming and usability, but that’s mostly it.

In some small points they even surpass SalesForce, like having an extra field to fill in competitors for a proposed deal, or having a timer to record call duration.

So why Zoho CRM?

Zoho CRM is a perfect tool for small businesses and/or freelancers. The free plan is sufficient for most of us. And when you start upgrading you get more features at a lower price than with SalesForce.

Somehow SalesForce just feels a bit more mature to me, even though Zoho CRM works great. That’s a matter of personal opinion, so you really should compare both if you are looking for an all-around CRM tool.

Zoho CRM does have one big advantage: cheap pricing and a free tier.

Do-it-Yourself: SugarCRM

I will conclude this list with SugarCRM, which offers both hosted and downloaded versions. The hosted version is quite expensive, and offers features you likely won’t need (like call center automation). I’ll instead focus on the downloaded version, which you can host yourself.

Features

SugarCRM is a very professional product. Keep in mind that the downloaded version is more limited in functionality than the hosted versions, and has a different layout.

The main reason to choose SugarCRM as a download is that you can keep your costs low (simple hosting is sufficient), and hosting it yourself may take away some privacy concerns.

SugarCRM’s basic functionalities are comparable to SalesForce and Zoho CRM when it comes to accounts, leads and opportunities.

But, it also has some unique features which are worth highlighting:

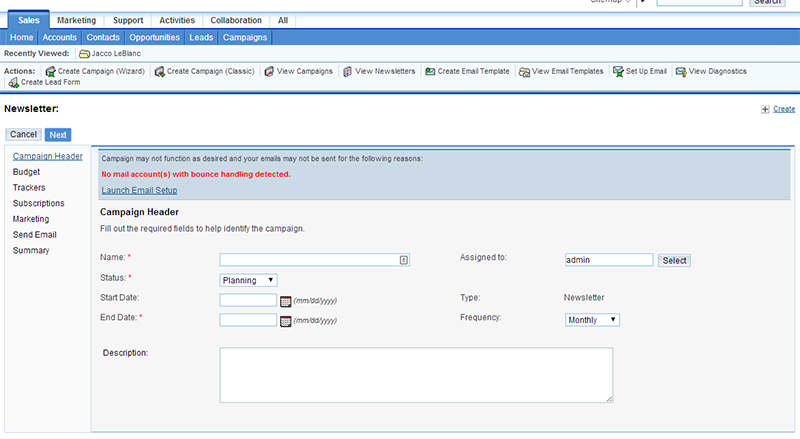

Campaigns

SugarCRM comes with a pretty powerful newsletter manager, including reporting. You can send your campaigns by email, but it also allows for offline campaigns (where you use SugarCRM for building your mailing list).

Targets / Target lists

If you want to contact someone which isn’t a qualified lead yet (say, someone who left their email address at a convention), you can make them a target (though that sounds a bit scary, doesn’t it?).

You can then group multiple targets in a target list, which is basically a very targeted mailing list. You can later on decide whether to ditch them as a prospect or move them up as a lead. This is perfect if you do a lot of cold calling, where you can build a target list to be approached by phone.

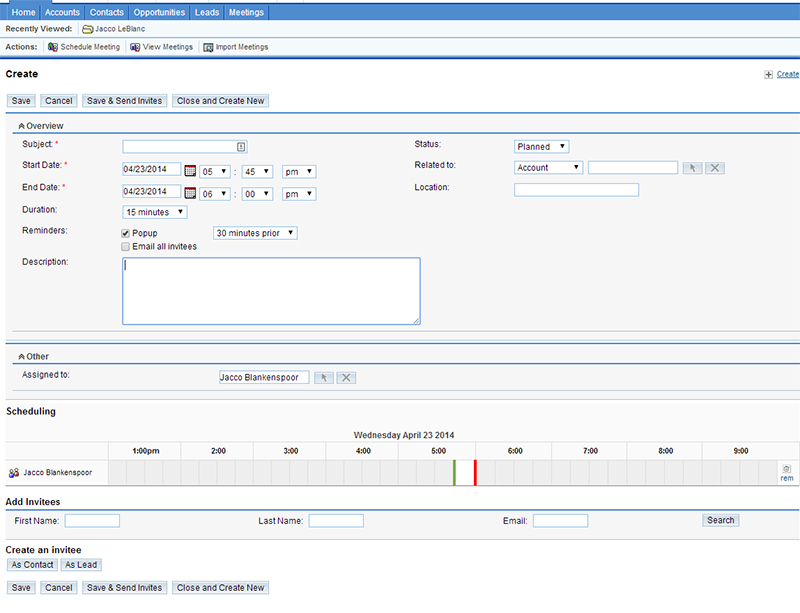

Meetings

SugarCRM comes with a very convenient way to schedule meetings, much like Outlook does but with even more detail.

So why SugarCRM?

Having it on your own server is just one of the benefits. The tool itself is surprisingly well featured for a free download version. And the extra functionality is quite useful as well.

The main downside is that you have no way of getting support for the free version other than community forums. There is also no reporting, though third-party plugins are available to create SugarCRM reports.

Round-up

What do you think of these tools? Are you using any of them yourself? If so, please share your experiences in the comments.

Frequently Asked Questions about CRM Tools for Freelancers and Small Businesses

What are the key features to look for in a CRM tool for freelancers and small businesses?

When choosing a CRM tool, freelancers and small businesses should consider several key features. First, the tool should be user-friendly and easy to navigate. It should also offer contact management capabilities, allowing you to track interactions with clients and leads. Other important features include task management, email integration, and reporting capabilities. Some CRM tools also offer additional features like project management, invoicing, and time tracking, which can be particularly useful for freelancers and small businesses.

How can a CRM tool help improve my business?

A CRM tool can significantly improve your business by helping you manage your client relationships more effectively. It allows you to track interactions with clients, manage tasks, and generate reports, giving you a clear overview of your business operations. This can lead to improved customer service, increased productivity, and ultimately, increased revenue.

Are there free CRM tools available for freelancers and small businesses?

Yes, there are several free CRM tools available that are suitable for freelancers and small businesses. These tools often offer basic features like contact management, task management, and email integration. However, they may have limitations in terms of the number of users or contacts, and may not offer advanced features like project management or invoicing.

How can I choose the right CRM tool for my needs?

Choosing the right CRM tool depends on your specific needs and budget. Consider the size of your business, the number of clients you have, and the features you need. It’s also important to consider the tool’s ease of use, customer support, and integration capabilities. You may want to try out a few different tools before making a decision.

Can I use a CRM tool if I’m not tech-savvy?

Yes, many CRM tools are designed to be user-friendly and easy to navigate, even for those who are not tech-savvy. They often offer tutorials and customer support to help you get started. However, if you’re not comfortable with technology, you may want to consider hiring a professional to help you set up and manage your CRM tool.

Can a CRM tool help me manage my time more effectively?

Yes, a CRM tool can help you manage your time more effectively by allowing you to track tasks, set reminders, and automate certain processes. This can free up time for you to focus on other aspects of your business.

Can I integrate a CRM tool with other software I use?

Yes, many CRM tools offer integration capabilities, allowing you to connect them with other software you use, such as email platforms, accounting software, and project management tools. This can help streamline your business operations and improve productivity.

Is it worth investing in a paid CRM tool?

Whether or not it’s worth investing in a paid CRM tool depends on your specific needs. If you need advanced features, have a large number of clients, or want to automate certain processes, a paid tool may be worth the investment. However, if you’re just starting out or have a small client base, a free tool may be sufficient.

How can a CRM tool help me improve my customer service?

A CRM tool can help you improve your customer service by allowing you to track interactions with clients, set reminders for follow-ups, and manage tasks related to customer service. This can help ensure that you’re providing timely and personalized service to your clients.

Can a CRM tool help me grow my business?

Yes, a CRM tool can help you grow your business by providing you with valuable insights into your clients and business operations. This can help you identify opportunities for growth, improve your marketing strategies, and make more informed business decisions.

Jacco Blankenspoor is a website developer from the Netherlands, and is currently just building lots of different websites. When he is not working on HIPAAHQ.com you might catch him grinding coffee.