Does Claim Management Work with AI Automation?

Visualize this, a person submits an insurance claim, and the claim gets approved, processed, and settled in a few minutes.

There is no room for endless documentation, back-and-forth calls, and dissatisfaction with the process. It must be a fairytale, isn’t it?

Thanks to the new life insurance claims software advancements and AI automation; this dream is now a reality for many insurers and policyholders.

AI enabled claims management transforms the insurance sector. But what is the process, and why do you think insurers should adopt AI to automate their claims process? Let us get into specifics.

How AI Automation Transforms Claims Management

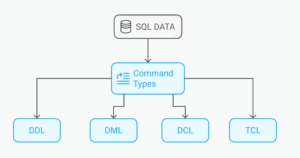

Fundamentally, addressing claims management within AI, in simple terms, is the conduct of claims within the framework of analyzing millions of structured and unstructured data in the organization’s database. AI automation performs functions that would have taken weeks, such as fraud detection through predictive algorithms; AI automation performs in a matter of minutes, thus speeding up resolution and increasing accuracy.

1) Simplifying Claims Processing

Traditional claims processing consists of routine operational stages, such as data entry or manual review of submitted documents. AI performs these tasks, allowing for STP for claims that meet the set requirements. This efficiency considerably reduces the turnaround time, meaning policyholders get faster to settlements.

For instance, for claim adjusters, Generative AI supplements summarised documents that routinely highlight the risk factors inherent within specific claims. This streamlining saves time and improves customer retention because people nowadays want to be served quickly.

2) Enhance Fraud Detection

Each year, insurance fraudsters cost the insurance industry billions of dollars. AI addresses this more interestingly by constantly analyzing data and looking for patterns.

For instance AI can identify patterns in claims data, such as repeated complaints with similar small or large claims and unusually sized repairs.

Did You Know? The insurance sector utilizes fraud detection as one of the most mature AI use cases, gaining substantial cost savings and strengthening operations.

3) Enable Predictive Claims Routing

AI categorizes and routes claims to the appropriate handler or automated system. Predictive claims routing uses machine learning models to analyze the complexity of each claim and determine the best course of action.

- Simple claims can be resolved instantly through automation.

- Complex claims are routed to human adjusters with AI-generated recommendations for the next steps.

This ensures efficient resource allocation and improves response times, directly enhancing customer experience.

Benefits of Life Insurance Claims Software with AI Automation

- Optimized Resources: AI reduces manual workloads, freeing claims teams to focus on high-value tasks like customer engagement and training.

- Enhanced Customer Experience: With faster resolutions and personalized interactions, policyholders enjoy a seamless claims process.

- Proactive Risk Management: Predictive analytics helps insurers anticipate risks and implement preventive measures, improving long-term outcomes.

Trends Shaping the Future of Claims Management

The insurance sphere is increasingly changing, and AI innovations are leading that change. Here are three trends reshaping claims management:

1) Increased Use of Telematics

Telematics devices collect real-time data on driving behavior, accident impact, and vehicle conditions. AI analyzes this data to:

- Reconstruct accidents.

- Detecting potential fraud.

- Provide personalized insurance quotes.

Fun Fact: Telematics-enabled claims processing reduces claim resolution times by up to 40%.

2) Higher Adoption of Computer Vision for Damage Assessment

Computer-generated vision powered by AI technology can analyze images and videos to evaluate damage in property and automotive claims. This diminishes the need for a person to inspect and, therefore, speeds up the process of approving and estimating damages.

3) Conversational AI for Personalized Interactions

AI chatbots and virtual assistants improve the customer experience by assisting them anytime. These tools can:

- Answer policyholder queries.

- Update claims status in real-time.

- Offer personalized policy recommendations.

Insurers using conversational AI report a 20% increase in customer satisfaction, making it a must-have for modern claims management.

Conclusion

As AI technologies grow, we should see even more perfection in claim automation. The insurers will use AI to carry out the intricate portions of the claims with minimal human involvement, allowing them to concentrate more on creativity and client satisfaction.

By integrating AI with robust life insurance claims software, insurers can transform their operations, delivering faster, fairer, and more efficient claims resolutions. Are you looking forward to the future of claims automation? Let’s make it happen!

Sponsored posts are provided by our content partners. Thank you for supporting the partners who make SitePoint possible.