All You Need to Know About Estonia’s E-Residency Program

Estonia has become the first country in the world to offer a transnational digital identity. It’s attracted the attention of entrepreneurs and digital nomads worldwide, but there’s still a huge amount of confusion about the benefits of the E-Residency Program and what e-residency actually means. Let’s take a look.

Key Takeaways

- Estonia’s E-Residency Program allows global citizens to remotely access government services and start an EU-based company, offering minimal bureaucracy and a clear tax framework. The program doesn’t grant actual residency or citizenship, but it does provide a transnational digital identity.

- The process to become an E-Resident involves completing an online application form, paying a fee of 50 euros, and receiving a digital ID card that authorizes access to Estonian services and enables digital document signing.

- The E-Residency Program offers several benefits including a low administrative burden, 0% corporation tax (with 20% income tax), the ability to open a euro-currency or multi-currency bank account, and access to online services such as PayPal. However, the program does not provide a way of avoiding tax.

What Is E-Residency?

It’s a way of accessing Estonia’s government services without ever actually visiting Estonia.

You can start a company with all the benefits of the EU legal framework as well as remotely access low maintenance administrative tools such as tax declaration and company formation. In 2009, Estonia broke a world record for the “fastest time to register a new legal entity” – 18 minutes.

In short, this beautiful Baltic country is offering remotely accessible services that would normally only be available to actual residents of Estonia. For digital nomad entrepreneurs that don’t have a fixed location, this is a huge deal and a big step towards full location-independence, and to top it off, it comes with minimal bureaucracy and a clear, desirable tax framework.

What Is E-Residency Not?

E-Residency does not mean actual residency. It’s not a visa, a right to remain, an identification card or citizenship, nor does it come with any of the social rights that Estonians locals have.

More importantly, it’s not a way of avoiding tax in any way, although I will elaborate on the tax benefits later on.

What Are the Benefits of Becoming An Estonian E-Resident?

Here’s a clearer, more concise list of benefits:

- Very low administrative burden

- 0% corporation tax (but 20% income tax)

- A euro-currency or multi-currency bank account

- More trust due to incorporating in a EU state

- Access to more online services such as PayPal

- Modern banking that can be managed remotely

- You specifically want a business in Estonia

- Save time and money by using government software

But here’s the big question, do you need to be an Estonian e-resident to have all of this? Well, the answer to that is no. You can set up a more cost-effective international bank account to avoid currency conversion fees, and you can start a company in a country with minimal accounting requirements or zero tax.

However, depending on where you reside and where you’re setting up shop, it can be difficult; usually, it’s impossible without having to immigrate or at least spend time in the country while you set up a bank account and sign documents.

Bottom line: becoming a resident or starting a company in another country usually feels like a bit of a hack. It’s possible, but few countries have actually made the effort to make the ordeal convenient. E-residency is the solution for the digital era.

How to Become an E-Resident

Chris Ward tells us in-depth how he actually applied for e-residency in Estonia, but I’ll sum up the steps quickly and then I’ll move on to some of the technical details.

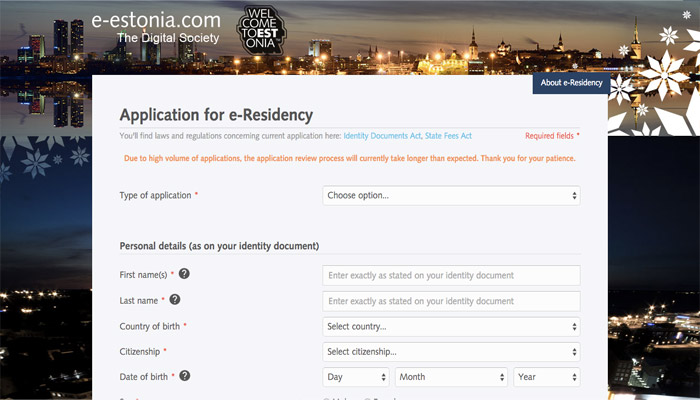

Step 1: Completing the Application Form

On the form you’ll be asked about your current citizenship, reasons for applying, and of course you can specify which country you’d like to collect the card from.

Step 2: Payment and Delivery

Many successful applicants have said that the card takes approximately a month to arrive at the embassy in whichever country you selected on the form. It costs 50 euros.

Step 3: Equipment

As well as the e-residency card you’ll also find a USB reader in the starter kit, and that combined with the reader software will authorise you to access Estonian services and digitally sign documents.

Starting a Company in Estonia

Just like when you incorporate a business entity in any other country, you need an address in that country – but before you say “ahh, so there’s the catch”, the address can be a virtual one. Since e-residency is still taking its first baby steps, we can expect things like this to become easier over time.

You can register a company online at the Company Registration Portal, which doesn’t take very long, using your Estonian E-Card.

Opening a Bank Account in Estonia

Estonian online banking is generally quite secure and user-friendly. Best of all, you can report tax directly from your bank account, saving you time, money, and of course sanity.

Finding a Virtual Address

Okay, so this one is a “gotcha”. You have to visit one of three banks (LHV, Swedbank or SEB) that supports e-residents to open a bank account, however your e-residency card can be used to digitally authorise the final step. E-Estonia is working on a way to make this a non-compliance; by Autumn 2016, e-residents will no longer be required to meet with a bank official face-to-face, and instead we’ll be able to use secure, virtual video chats.

Paying Tax (Where Everybody Gets Confused)

Estonia has a very unique and desirable tax system. First of all, there is zero corporation tax, meaning that only employees are subjected to income tax of which they are responsible for.

As for the shareholders of the company, they only pay tax on distributed profits. Basically, when they’re issued a dividend. If you’re not receiving a dividend, you’re not subjected to tax and you can reinvest those funds into company growth instead.

Who Pays Tax On Dividends?

Your company foots the tax bill when the dividends are distributed, although each shareholder is still liable for income tax in their own country of residence. Remember, e-residency doesn’t mean that you’re an Estonian resident, although you can still become a tax resident in Estonia if you choose to stay there indefinitely.

Where Do You Pay Income Tax?

It doesn’t mean that you’ll be taxed twice, though. Most countries have double-taxation laws and you’ll need to consult the relevant tax treaties between your resident country and Estonia.

Sometimes you’ll be taxed on foreign income, sometimes you won’t; the rules differ from one country to the next depending on the level of interaction with your home country. Being “resident for tax reasons” nowhere is entirely feasible, although many digital nomads make the mistake of assuming it applies to them.

Always, always, always consult legal advice.

Conclusion

In the first 7 months, over 4,000 entrepreneurs and digital nomads applied for e-residency, and for only 50 euros, you can do the same. If you have any further questions, Kaspar Korjus (Director of the Estonia E-Residency Program) recently did an AMA on Nomad Forum where he clarified some of the more confusing aspects of Estonian e-residency.

I wanted to say a big thank you to Sebastian Johnsson for letting me use his images. Sebastian aims to remotely open a bank account in Estonia, but doesn’t want to start a company there because the tax rate isn’t as tempting as Malta’s (where he currently lives). Estonia’s e-residency benefits individuals as well as companies.

A thank you to Yulcu Iskender as well, who wants to move his business to Europe in order to benefit from everything that the European Union has to offer, and Skyler Shaw who finds the tax benefits very advantageous.

Frequently Asked Questions about Estonia’s E-Residency Program

What are the benefits of Estonia’s E-Residency program?

The E-Residency program in Estonia offers a wide range of benefits. It allows global citizens to start and manage an EU-based company online. This means you can conduct business without physically being in Estonia or even Europe. It also provides access to Estonia’s advanced digital infrastructure and services, including banking, payment processing, and taxation. Moreover, it offers the freedom to operate your business remotely from anywhere in the world, making it an attractive option for digital nomads, freelancers, and entrepreneurs.

How can I apply for Estonia’s E-Residency program?

Applying for Estonia’s E-Residency program is a straightforward process. You can apply online through the official E-Residency website. The application requires your personal details, a passport-style photo, a scanned copy of your government-issued ID, and a statement of intent explaining why you want to become an e-resident. After submitting your application, it will be reviewed by the Estonian Police and Border Guard Board.

What is the cost of the E-Residency program?

The cost of applying for the E-Residency program is €100. This fee is non-refundable and covers the cost of processing your application. There may be additional costs associated with setting up and running a company in Estonia, such as company registration fees and annual reporting fees.

How long does it take to get E-Residency?

The processing time for an E-Residency application typically takes between 6-8 weeks. Once your application is approved, you will receive an email notification and your digital ID card will be sent to the Estonian embassy or consulate you selected during the application process.

Can I travel to Estonia with E-Residency?

E-Residency does not grant you the right to enter or reside in Estonia or the European Union. It is a digital residency that provides access to Estonia’s e-services. For travel purposes, you would still need to follow the standard visa or immigration procedures applicable to your nationality.

Can I open a bank account in Estonia with E-Residency?

Yes, E-Residency allows you to open an Estonian bank account. However, it’s important to note that the decision to open a bank account is ultimately at the discretion of the bank. Some banks may require a face-to-face meeting in Estonia, while others may allow online account opening.

Is my data secure with E-Residency?

Estonia has robust data protection laws and regulations in place to ensure the security of your personal information. The digital ID card provided by the E-Residency program uses 2048-bit public key encryption, making it extremely secure.

Can I use E-Residency to start a business in any industry?

E-Residency allows you to start and manage a business in Estonia, but there may be restrictions depending on the industry. Certain regulated industries, such as financial services, may require additional licenses or permits.

Do I need to pay taxes in Estonia as an e-resident?

As an e-resident, you are responsible for paying taxes on any income generated through your Estonian company. However, if you are not a resident of Estonia and do not conduct business activities in the country, you may not be subject to Estonian income tax. It’s recommended to consult with a tax advisor to understand your tax obligations.

Can I become an e-resident if I already have a business?

Yes, existing business owners can also benefit from the E-Residency program. It can provide a more efficient way to manage your business operations, especially if you conduct business internationally.

Previously, design blog editor at Toptal and SitePoint. Now Daniel advocates for better UX design alongside industry leaders such as Adobe, InVision, Marvel, Wix, Net Magazine, LogRocket, CSS-Tricks, and more.