When it comes to getting paid for your goods and services, one name dominates the field — PayPal. But PayPal isn’t the only game in town — there are lots of payment providers in the online space. We’ll explore how they can give you more choice, enhance your cashflow, and put money in your pocket.

But PayPal is Great, Why Do I Need an Alternative?

PayPal is dominant for a reason — it has been around the longest, it’s spent millions enhancing its brand, and it provides all the standard functions you’d expect. However, that doesn’t always make it the best choice. Here’s why:- Not all clients can make PayPal payments. Some of your clients simply can’t, or won’t, use PayPal. They might not be in an area that PayPal accepts payments from, or their accounting systems don’t support PayPal. Perhaps they’ve had a bad experience with the platform, or want an easier way to pay.

- You don’t want all your (online payment) eggs in one basket. PayPal is notorious for blocking accounts. That means you can’t receive payments or access your funds until they decide to unblock you. The lack of cashflow could leave you vulnerable, so alternative payment options are essential.

- PayPal is best for smaller amounts. The fees you pay for PayPal can really add up, especially on larger transactions. Other payment providers may charge lower fees, so you keep costs down (and that means greater profits).

- PayPal’s international fees are really (really) high. If you dig into PayPal’s fees, you’ll see they charge a big premium for accepting international payments. Combine this with less than ideal exchange rates, and you’ll pay a hefty overhead for any international business.

Stripe

One of PayPal’s biggest competitors, Stripe offers a simple, easy user interface, full payment integration, and fast transfers into your bank account.

One of PayPal’s biggest competitors, Stripe offers a simple, easy user interface, full payment integration, and fast transfers into your bank account.

Advantages of Stripe

- Ease of use. Simple and easy to use and setup.

- Bank account transfer. Very fast transfer into your bank account (within two days of getting payment).

- Complete integrations. Full payment integration with most third-party services, works with over 300 other apps.

- Multiple payment options for customers. Accepts payment via multiple debit and credit cards, Bitcoin, Apple Pay and Android Pay.

- International customers. No additional international payment fees.

- Customization. Full support for custom development and integration.

Stripe Fees

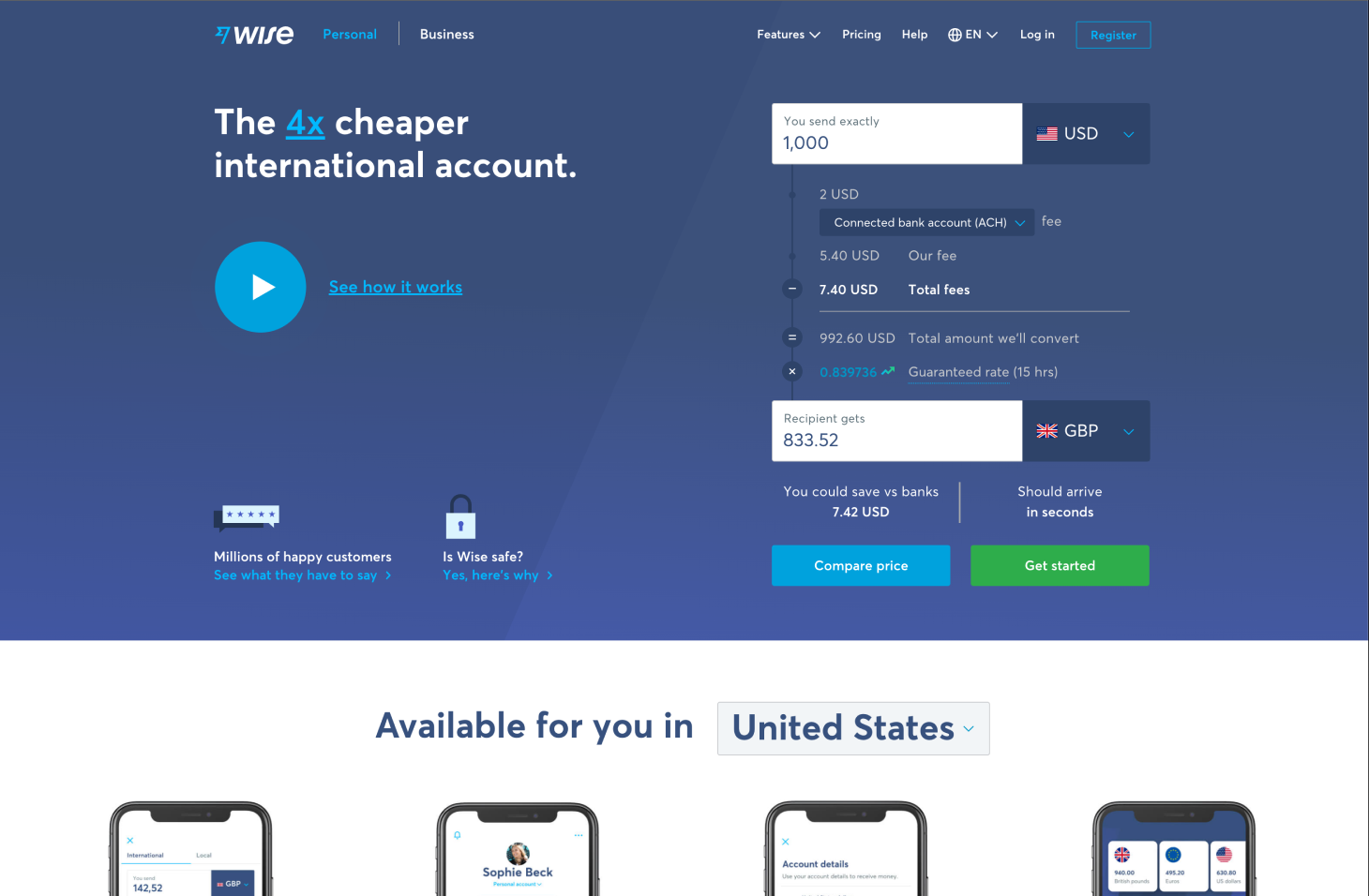

In the US, Stripe charges a flat fee of 2.9% of every transaction, plus an additional 30c per transaction. There are no other fees for processing transactions.Wise (formerly TransferWise)

Wise (formerly TransferWise) is a little different to the other services listed here, as their focus is entirely on international payments. They’re a great choice if you have lots of international customers and want to keep fees down.

Wise (formerly TransferWise) is a little different to the other services listed here, as their focus is entirely on international payments. They’re a great choice if you have lots of international customers and want to keep fees down.

Advantages of Wise

- Lets you accept payments from clients, anywhere in the world.

- Receive payment into your bank account within 2 – 3 days of being paid.

- Simple, fast, and easy to use.

- All transfers are based on real-time exchange rates.

Wise Fees

- Wise fees are very low, and are typically less than half of what you would pay to transfer money via your bank.

- Wise provides much better exchange rates than most other international payment providers, especially PayPal.

Google Wallet

As the biggest tech player in the online space, Google naturally has its own payment solution. Google Wallet is a simple, elegant, and free way to accept payments.

As the biggest tech player in the online space, Google naturally has its own payment solution. Google Wallet is a simple, elegant, and free way to accept payments.

Advantages of Google Wallet

- Receive money from anyone. They don’t need to have the Wallet app installed, just an email address or phone number.

- Automatic transfer to your bank account. Google Wallet automatically transfers your received payments into your bank.

- Payment through the web or a mobile app. Customers can pay through Google wallet’s website, or through a mobile app on their smartphone.

Google Wallet Fees

Google Wallet does not charge any fees. Note that you can’t use Google Wallet if you’re a registered company (e.g. a Limited or LLC entity) but you can use it if you’re a sole proprietor.Shopify Payments

If you’re an online retailer or run an eCommerce site, Shopify’s integrated payment system can be a great way to get payments from customers. Shopify Payments comes as part of the overall Shopify eCommerce service.

If you’re an online retailer or run an eCommerce site, Shopify’s integrated payment system can be a great way to get payments from customers. Shopify Payments comes as part of the overall Shopify eCommerce service.

Advantages of Shopify Payments

- Built into Shopify. Works with the overall Shopify eCommerce platform for a seamless customer experience. The Shopify platform has dozens of other features.

- Integrates with other apps and systems. Integration with third party payment processors and other apps, including Facebook Shop, Twitter, and Pinterest.

- International payments. Accept payments from international customers in the UK, US, Canada, and Australia at no additional charge.

- Accounting. Works with many online accounting apps to make reconciliation and reporting easier.

Shopify Fees

Shopify charges a monthly fee for its overall eCommerce platform, available in a variety of plans. The amount you pay for Shopify payments depends on which plan you use. In the U.S. the fees are:- Shopify Basic: 2.9% + 30c per transaction.

- Shopify Pro: 2.6% + 30c per transaction.

- Shopify Unlimited: 2.4% + 30c per transaction.

Fondy

Fondy is a cross-platform payment platform for every size of business, and accepts payments from any country. It supports more than 100 currencies, cooperates with the banks of the European Union, Eastern Europe, Great Britain and is expanding its presence around the world.

FONDY is only available to sellers in the European market.

Fondy is a cross-platform payment platform for every size of business, and accepts payments from any country. It supports more than 100 currencies, cooperates with the banks of the European Union, Eastern Europe, Great Britain and is expanding its presence around the world.

FONDY is only available to sellers in the European market.

Advantages of Fondy

- A wide range of payment methods: credit cards, local payment, Internet and mobile banking, recurring payments and more allow sellers to easily adjust to customer needs. The ability to pay in a convenient way increases customer loyalty and helps entrepreneurs earn more.

- Fast and friendly onboarding: the process from registration to accepting payments takes 2-3 hours.

- Strong analytical merchant panel: allows sellers to gain constant insight into their business in real-time and advanced analyses help to adjust marketing campaigns or other activities.

- Maximum security level: three levels of anti-fraud protection, SSL/TLS encryption, 3D Secure technology.

Fondy Fees

- Receiving payments via bank transfer starts at 1.2% depending on the business model and transaction volume.

- Receiving payments via credit or debit card attracts a 1.8 – 1.6% fee (depending on turnover). For non-European cards the fee is 3.2%.

- Transactional fee: €0.2 per transaction.

Amazon Payments

Unlike Shopify Payments, the Amazon Payments system isn’t just limited to selling on Amazon. You can integrate the Amazon Payments system in many different ways and let people pay for goods and services with their stored Amazon account details.

Unlike Shopify Payments, the Amazon Payments system isn’t just limited to selling on Amazon. You can integrate the Amazon Payments system in many different ways and let people pay for goods and services with their stored Amazon account details.

Advantages of Amazon Payments

- Branding. Strong Amazon branding creates trust with your users.

- Payment details already available. Due to the huge number of Amazon customers, their payment details are already stored making payment quick and easy.

- One click payments. Customers can order and pay for goods with one click.

Amazon Payment Fees

Amazon charges slightly different amounts for domestic and international payments. In the U.S. the fees are as follows:- Domestic payments: A flat fee of 2.9% of every transaction, plus an additional 30c per transaction.

- International payments: A flat fee of 3.9% of every transaction, plus an additional 30c per transaction.

Payoneer

Payoneer is a complete, integrated, fully-featured payment platform. It has a strong focus on international transactions and payments, making it easy to get paid by clients and customers around the world.

Payoneer is a complete, integrated, fully-featured payment platform. It has a strong focus on international transactions and payments, making it easy to get paid by clients and customers around the world.

Advantages of Payoneer

- Fast payments. Receive funds within minutes of getting paid.

- Send payment requests. Multiple options for invoicing, billing, and getting paid.

- Easy to make payments. If you need to send money to others, Payoneer makes it easy to send bulk payments to multiple recipients.

- Global payment services. Setup a “virtual bank account” so you can receive payments in multiple currencies. You can withdraw funds to your local bank account at any time.

Payoneer Fees

- Receiving funds from another Payoneer customer is free.

- Receiving payments from your international, virtual bank accounts is free for many currencies and attracts a 1% fee for US dollars.

- Receiving payments via a credit or debit card attracts a 3% fee.

Authorize.net

Authorize.net is one of the most established payment providers there is, with more than 20 years of experience in providing payment services.

Authorize.net is one of the most established payment providers there is, with more than 20 years of experience in providing payment services.

Advantages of Authorize.net

- Payment types. Accepts payments from all major debit and credit cards, Android Pay, Apple Pay, eCheck, and Visa Checkout.

- International payments. Accept money from clients and customers around the world.

- Development APIs. Allows integration with other apps to understand and process transaction details.

- Customer information. Securely store customer information to make future purchases easier.

Authorize.net Fees

- $49 setup fee and a $25 monthly fee.

- Domestic payments: A flat fee of 2.9% of every transaction, plus an additional 30c per transaction.

- International payments: An additional fee of 1.5% of every transaction.

Payline Data

Payline Data takes an innovative approach to collecting money. In addition to a standard checkout system, API, and mobile payments, clients can also schedule appointments and pay at the same time. Their fees are also extremely low.

Payline Data takes an innovative approach to collecting money. In addition to a standard checkout system, API, and mobile payments, clients can also schedule appointments and pay at the same time. Their fees are also extremely low.

Advantages of Payline Data

- Payline Gateway. Allows clients to pay securely online, through integration with many other apps and services.

- Point of sale. Provides a point of sale service and hardware to support face-to-face transactions.

- Integration. A fully featured API allows for seamless connection and integration to other apps and providers.

- Mobile. Allows for mobile payments.

Payline Data Fees

- $15 monthly fee.

- A flat fee of 0.35%, plus an additional 10c per transaction.

Other Services

There are hundreds of other online and face-to-face payment services available. When you’re comparing, here’s some useful advice:- Always look at all the fees. Some payment processors charge hidden fees. Always review the entire fee schedule so you can do a like-for-like comparison.

- Explore other supported features. If you want recurring billing, subscription services, point of sale support, or other options, make sure you understand all of the features.

- Custom integrations. Explore options for customizing the API and integrations with other apps to help all your various SaaS apps work together better.

Frequently Asked Questions about PayPal Alternatives

What are some of the most secure alternatives to PayPal?

Security is a top concern when it comes to online transactions. Alternatives to PayPal such as Stripe, Square, and TransferWise have robust security measures in place. Stripe, for instance, uses machine learning algorithms to detect and prevent fraud. Square has a team of experts dedicated to detecting and preventing suspicious activity. TransferWise, on the other hand, is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring that your money is handled with the utmost care and security.

Are there any PayPal alternatives that offer lower fees?

Yes, there are several PayPal alternatives that offer lower fees. For instance, Payoneer charges a flat fee of 1% for receiving payments, which is lower than PayPal’s 2.9% plus 30 cents per transaction. Stripe also charges a lower fee of 2.9% plus 30 cents per transaction, but only for businesses that process less than $1 million in annual payments.

Which PayPal alternatives are best for international transactions?

TransferWise and Payoneer are excellent for international transactions. TransferWise uses the real exchange rate and charges a small, upfront fee, making it a cost-effective option. Payoneer, on the other hand, allows you to receive payments in multiple currencies, making it ideal for businesses with international clients.

Are there any PayPal alternatives that integrate with my e-commerce platform?

Yes, many PayPal alternatives offer seamless integration with popular e-commerce platforms. For instance, Stripe integrates with platforms like Shopify, BigCommerce, and WooCommerce. Square also integrates with many e-commerce platforms and offers additional features like inventory management and sales reports.

Which PayPal alternatives offer the best customer support?

Customer support is crucial when dealing with financial transactions. Stripe and Square are known for their excellent customer support. Stripe offers 24/7 support via email, chat, and phone, while Square offers phone support during business hours and email support around the clock.

Are there any mobile-friendly PayPal alternatives?

Yes, many PayPal alternatives offer mobile-friendly solutions. Square, for instance, offers a mobile app that allows you to accept payments on the go. Stripe also offers a mobile app, and its checkout is designed to be mobile-friendly.

Which PayPal alternatives offer the fastest payment processing times?

Stripe and Square offer fast payment processing times. Stripe deposits funds into your bank account within two business days, while Square offers instant transfers for a small fee.

Are there any PayPal alternatives that offer payment dispute resolution?

Yes, many PayPal alternatives offer payment dispute resolution. Stripe, for instance, provides tools and guidance to help you resolve disputes and avoid chargebacks. Square also offers dispute management tools and will even represent you in a dispute with a customer.

Which PayPal alternatives offer the most payment options?

Stripe and Square offer a wide range of payment options. Stripe supports over 135 currencies and a variety of payment methods, including credit cards, debit cards, and mobile wallets. Square accepts all major credit cards and mobile wallets, and also offers the option to accept gift cards.

Are there any PayPal alternatives that offer additional business services?

Yes, many PayPal alternatives offer additional business services. For instance, Square offers a suite of business tools, including payroll services, marketing tools, and customer loyalty programs. Stripe also offers additional services, such as fraud protection and business analytics.

Paul Maplesden

Paul MaplesdenPaul Maplesden is a freelance writer specializing in business, finance, and technology. He loves Earl Grey tea, pivot tables, hats, and other fine geekery.