Part I: Core Concepts

Chapter 1: Achieving Product-Market Fit with the Lean Product Process

Product-market fit is a wonderful term because it captures the essence of what it means to build a great product. The concept nicely encapsulates all the factors that are critical to achieving product success. Product-market fit is one of the most important Lean Startup ideas, and this playbook will show you how to achieve it.

Given the number of people who have written about product-market fit, you can find a range of interpretations. Real-world examples are a great way to help explain such concepts—throughout this book, I walk through many examples of products that did or didn't achieve product-market fit. But let's start out by clarifying what product-market fit means.

What Is Product-Market Fit?

As I mention in the introduction, Marc Andreessen coined the term product-market fit in a well-known blog post titled “The only thing that matters.” In that post he writes, “Product-market fit means being in a good market with a product that can satisfy that market.” My definition of product-market fit—which is consistent with his—is that you have built a product that creates significant customer value. This means that your product meets real customer needs and does so in a way that is better than the alternatives.

Some people interpret product-market fit much more broadly, going beyond the core definition to also include having a validated revenue model—that is, that you can successfully monetize your product. For others, product-market fit also includes having a cost-effective customer acquisition model. Such definitions basically equate product-market fit with having a profitable business. I believe using “product-market fit” as another way of saying “profitable” glosses over the essential aspects of the idea, which can stand on its own.

In this book, I use the core definition above. In business, there is a distinction between creating value and capturing value. In order to capture value, you must first create it. To be clear, topics such as business model, customer acquisition, marketing, and pricing are critical to a successful business. Each is also worthy of its own book. This book touches on those subjects, and you can use the qualitative and quantitative techniques in it to improve those aspects of your business. In fact, Chapters 13 and 14 discuss how to optimize your business metrics, but the majority of this book focuses on the core definition of product-market fit and gives you a playbook for how to achieve it.

The Product-Market Fit Pyramid

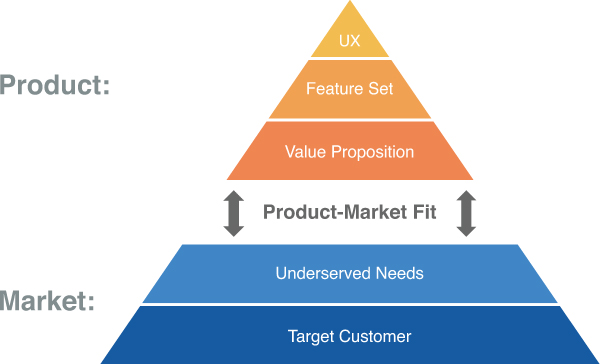

If you're trying to achieve product-market fit, a definition alone doesn't give you enough guidance. That's why I created an actionable framework called the Product-Market Fit Pyramid, shown in Figure 1.1. This hierarchical model decomposes product-market into its five key components, each a layer of the pyramid. Your product is the top section, consisting of three layers. The market is the bottom section of the pyramid, consisting of two layers. Within the product and market sections, each layer depends on the layer immediately beneath it. Product-market fit lies between the top and bottom sections of the pyramid.

Figure 1.1 The Product-Market Fit Pyramid

The Market

Given the pyramid's hierarchy, let's start with the bottom section, which is the market. A market consists of all the existing and potential customers that share a particular customer need or set of related needs. For example, all the people in the United States who need to prepare their income taxes are in the U.S. tax preparation market. You can describe the size of a market by the total number of customers in the market or the total revenue generated by those customers. For either of those two measures, you can refer to the current size or the potential future size of the market.

Different customers within a market choose different solutions to meet their needs. For example, some customers in the tax preparation market may use a professional service such as H&R Block. Others may choose to prepare their taxes themselves, either by hand or by using software such as TurboTax.

Within a given market, you can analyze the market share of each competing product—that is, what percentage of the market each product has. For example, you could compare the smartphone market share of Apple versus Samsung. Or you could segment the smartphone market by operating system (iOS, Android, and so forth). Browsers are another example where the market shares of each different product are closely watched.

As you walk down the aisles of a supermarket, you see products in many different market categories: toothpaste, shampoo, laundry detergent, cereal, yogurt, and beer, to name a few. The life cycle stage of a market can vary. Many of the products you see—such as milk, eggs, and bread—are in relatively mature markets, with little innovation or change. That being said, new markets do emerge. For example, Febreze basically created its own market with a new product that eliminates odors from fabrics without washing them. Prior to its launch, that market didn't exist. You also see active competition in many markets, with companies trying to gain market share through product innovation.

The Product-Market Fit Pyramid separates the market into its two distinct components: the target customers and their needs. The needs layer is above the target customers layer in the model because it's their needs that are relevant to achieving product-market fit.

As you try to create value for customers, you want to identify the specific needs that correspond to a good market opportunity. For example, you probably don't want to enter a market where customers are extremely happy with how the existing solutions meet their needs. When you develop a new product or improve an existing product, you want to address customer needs that aren't adequately met. That's why I use “underserved needs” as the label for this layer. Customers are going to judge your product in relation to the alternatives. So the relative degree to which your product meets their needs depends on the competitive landscape. Let's move now to the product section of the pyramid.

Your Product

A product is a specific offering intended to meet a set of customer needs. From this definition, it's clear that the concept of product-market fit applies to services as well as products. The typical distinction between a product and service is that a product is a physical good while a service is intangible. However, with products delivered via the web and mobile devices, the distinction between product and service has been blurred, as indicated by the popular term software as a service (SaaS).

For software, the product itself is intangible code, often running on servers that the customer never sees. The real-world manifestation of software products that customers see and use is the user experience (UX), which is the top layer of the Product-Market Fit Pyramid. Beyond software, this is also true for any product with which the customer interacts. The UX is what brings a product's functionality to life for the user.

The functionality that a product provides consists of multiple features, each built to meet a customer need. Taken together, they form the product's feature set, which is the layer just below the UX layer.

To decide which features to build, you need to identify the specific customer needs your product should address. In doing so, you want to determine how your product will be better than the others in the market. This is the essence of product strategy. The set of needs that you aspire to meet with your product forms your value proposition, which is the layer just below “feature set” in the Product-Market Fit Pyramid. Your value proposition is also the layer just above customer needs, and fundamentally determines how well the needs addressed by your product match up with the customer's.

Taken together, the three layers of value proposition, feature set, and UX define your product. As shown in Figure 1.1, your product and the market are separate sections of the Product-Market Fit Pyramid. Your goal in creating customer value is to make them fit nicely together.

Product-Market Fit

Viewing product-market fit in light of this model, it is the measure of how well your product (the top three layers of the pyramid) satisfies the market (the bottom two layers of the pyramid). Your target customers determine how well your product fits their needs. Again, customers will judge your product's fit in relation to the other products in the market. To achieve product-market fit, your product should meet underserved needs better than the competition. Let's discuss a product that managed to do that.

Quicken: from #47 to #1

A great example of a product that achieved product-market fit while entering an already crowded market is Intuit's Quicken personal finance software. Scott Cook and Tom Proulx practiced Lean principles even though they founded Intuit years before Lean Startup ideas were put forth. When they launched Quicken, there were already 46 personal finance products in the market. However, after conducting customer research, the cofounders concluded that none of the existing products had achieved product-market fit. The products didn't meet customer needs and were difficult to use. The cofounders had a hypothesis that a checkbook-based design would do well, since everyone at the time was familiar with writing checks. Their hypothesis proved right: the UX they built using the checkbook conceptual design resonated with customers and Quicken rapidly became the leading personal finance software.

A large part of Quicken's success was the fact that Intuit adopted principles that would be called Lean today. The company pioneered the use of customer research and user testing to inform software development. They routinely conducted usability testing of each version before launching it and organized public betas years before those ideas became mainstream. They invented the “follow me home” concept, where Intuit employees would go to retail stores, wait for customers to buy a copy of Quicken, and then ask to follow them home to see how they used the software. This helped immensely in understanding the customer's initial impressions of the product.

Let's assess Quicken using the Product-Market Fit Pyramid. There were many customers in its market, and the product definitely addressed real customer needs: People needed help balancing their checkbook, tracking their balances, and seeing where their money was going. Computer software was well suited to help on that front, but despite 46 products in the market, customer needs were still underserved. By talking with customers, the cofounders ensured Quicken's feature set addressed those needs. Their design insights led to an innovative UX that customers found much easier to use. This dramatic improvement in ease of use was, in fact, the main differentiator in Quicken's value proposition. By achieving product-market fit, Quicken succeeded in the face of stiff competition, which led the founders to joke about having “47th mover advantage.”

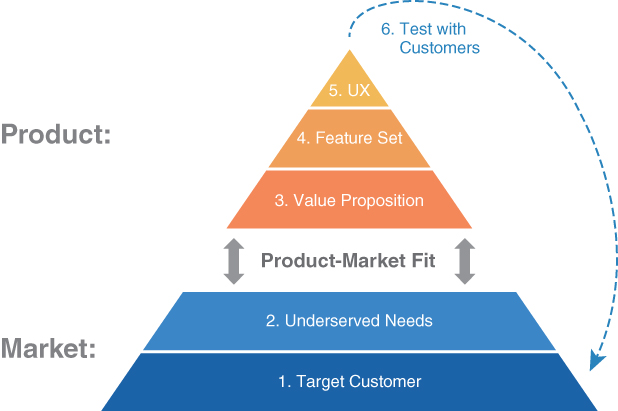

The Lean Product Process

Now that we have a detailed model for product-market fit, how do we go about achieving it? Based on my experience using the Product-Market Fit Pyramid with many teams on numerous products, I designed a simple, iterative process for achieving product-market fit. The Lean Product Process, shown in Figure 1.2, guides you through each layer of the pyramid from the bottom up. It helps you articulate and test your key hypotheses for each of the five components of product-market fit.

Figure 1.2 The Lean Product Process

I describe the six steps of the Lean Product Process in detail in Part II of this book, with a chapter devoted to each one:

- Determine your target customers

- Identify underserved customer needs

- Define your value proposition

- Specify your minimum viable product (MVP) feature set

- Create your MVP prototype

- Test your MVP with customers

The last three steps reference the important Lean concept of a minimum viable product (MVP). I discuss MVP in detail in Chapters 6 and 7, but it's basically the minimum amount of functionality that your target customer considers viable, that is, providing enough value. When you are building a new product, you want to avoid building more than is required to test your hypotheses with customers. The term MVP clearly applies when you're building a completely new version 1 product (v1 for short). In addition, the idea of an MVP makes sense if you are redesigning an existing product or building v2.

The Lean Product Process also applies when you are not building a whole product, such as when you add functionality to or improve an existing product. In those situations, you can think of the process steps applying to a “minimum viable feature” instead, if that's clearer.

Step 5 also refers to your MVP prototype. I intentionally use this broad term to capture the wide range of product-related artifacts you can test with customers. While the first “prototype” you test could be your live product, you can gain faster learning with fewer resources by testing your hypotheses before you build your product.

Not all six steps are required for every product or feature. Certain steps are required only when you're building a completely new product. Take, for example, determining your target customers, identifying underserved needs, and defining your value proposition. Once you've successfully completed those steps for your product, you may not need to revisit those areas for a while. But after launching your v1 product, you would continue to improve and add functionality by looping through the three remaining steps: specifying which features to pursue, creating the features, and testing the features with customers.

To increase your chances of achieving product-market fit, the process is designed to encourage a certain amount of rigor in product thinking. In a sense, the process is a checklist to help make sure you've thought about the key assumptions and decisions to be made when creating a product. If you are not making these assumptions or decisions explicitly, then you are making them implicitly. The Lean Product Process helps you articulate the assumptions and hypotheses in your head (which you can revise later as you iterate). If you skip these critical thinking steps, you leave important elements—such as target customer and product strategy—to chance.

A key concept in Lean manufacturing, which inspired Lean Startup, is the concept of rework: having to spend time fixing something that you did not build correctly the first time. Minimizing rework is a key tactic for eliminating waste. In addition to helping you achieve product-market fit, the Lean Product Process also enables you to do so more quickly by reducing rework.

To be clear, you will have some rework with the Lean Product Process. It is an iterative process that requires you to revise your hypotheses, designs, and product as you make progress—all of which could be considered rework. The goal of the process is to achieve product-market fit as quickly as possible. Quick but rigorous thinking that avoids or reduces rework helps achieve that goal.

You can think of the Lean Product Process like the drills that karate students learn and practice as they make progress earning higher and higher belts. After mastering the core techniques from their drills and becoming black belts, students are able to mix, match, and modify what they have learned to create their own custom style. Martial arts master Bruce Lee eloquently said, “Obey the principles without being bound by them.” He also said, “Adapt what is useful, reject what is useless, and add what is specifically your own.” I encourage you to heed his advice as you read and practice the ideas and guidance in this book.

Along those lines, I would enjoy hearing any questions or feedback you have, as well as your experiences applying the ideas in this book. Please feel free to share them at the companion website for this book: http://leanproductplaybook.com. There, you can also see the latest information related to the book and contribute to the conversation about how to build great products.

Before jumping to the first step of the Lean Product Process, I discuss in the next chapter the important concept of problem space versus solution space. Understanding this fundamental idea will help clarify our thinking as we work our way up the Product-Market Fit Pyramid.

Chapter 2: Problem Space versus Solution Space

The Lean Product Process will guide you through the critical thinking steps required to achieve product-market fit. In the next chapter, I begin describing the details of the process, but before I do, I want to share an important high-level concept: separating problem space from solution space. I have been discussing this concept in my talks for years and am glad to see those terms used more frequently these days.

Any product that you actually build exists in solution space, as do any product designs that you create—such as mockups, wireframes, or prototypes. Solution space includes any product or representation of a product that is used by or intended for use by a customer. It is the opposite of a blank slate. When you build a product, you have chosen a specific implementation. Whether you've done so explicitly or not, you've determined how the product looks, what it does, and how it works.

In contrast, there is no product or design that exists in problem space. Instead, problem space is where all the customer needs that you'd like your product to deliver live. You shouldn't interpret the word “needs” too narrowly: Whether it's a customer pain point, a desire, a job to be done, or a user story, it lives in problem space.

The Space Pen

My favorite story to illustrate the concept of problem space versus solution space is the space pen. When NASA was preparing to send astronauts into space, they knew that ballpoint pens would not work because they rely on gravity in order for the ink to flow. One of NASA's contractors, Fisher Pen Company, decided to pursue a research and development program to create a pen that would work in the zero gravity of space. After spending $1 million of his own money, the company's president, Paul Fisher, invented the Space Pen in 1965: a wonderful piece of technology that works great in zero gravity.

Faced with the same challenge, the Russian space agency equipped their astronauts with pencils. You can actually buy a “Russian space pen” (which is just a cleverly packaged red pencil).

This story shows the risk of jumping into the solution space prematurely and the advantage of starting in the problem space. If we constrain our thinking to “a pen that works in zero gravity,” we may not consider creative, less-expensive solutions such as a pencil. In contrast, having a clear understanding of the problem space (devoid of any solution space ideas), allows for a wider range of creative solutions that potentially offer a higher return-on-investment. If the pencil and space pen were equally adequate solutions, then avoiding one million dollars of research and development cost would clearly be the preferable alternative.

To avoid fixating on pen-based solutions, we could rephrase the problem space as: “a writing instrument that works in zero gravity.” That would allow for a pencil as a solution. But that's still anchored on “a writing instrument” solution. We can do even better than that: “a way to record notes in zero gravity for later reference that is easy to use.” That problem space statement would allow for more creative solutions such as voice recording with playback. In fact, considering out-of-the-box solution ideas can help you refine your problem space definition, even if they aren't feasible. In this case, a voice recorder would probably not be as good a solution as a Space Pen. It would need a power source and would require playback to refer to the notes again, which would be less convenient than being able to scan and read them. But undergoing this thought exercise would allow us to further refine our problem space definition to: “a way to record notes in zero gravity for convenient reference later on that is easy to use, is inexpensive, and does not require an external power source.”

I always like to clarify that this example is by no means an attempt to make fun of NASA. I tell the story a certain way to highlight the point I want to make. Indeed, the conclusion that NASA came to turned out to be the best one. There are good reasons not to use pencils in space: the lead tips can break off and float into an astronaut's eye or cause a short in an electrical connection. After the tragic Apollo 1 fire in 1967, NASA required all objects in the cabin to be nonflammable, including the writing instruments. So the Space Pen actually was a useful innovation, which the Russian space agency also adopted.

When I mention the space pen in my talks, there is often someone who claims that the story is an urban legend. However, it isn't, as NASA explains at http://history.nasa.gov/spacepen.html, and the Fisher Space Pen Company confirms at http://fisherspacepen.com/pages/company-overview. The key point of debate usually is, who spent the money on research and development: NASA or Fisher? Fisher did, as I pointed out above.

Problems Define Markets

Early in my product career, Intuit's founder Scott Cook helped me solidify the concept of problem space versus solution space when I heard him talk about TurboTax. Speaking to a group of product managers, Scott asked us, “Who is TurboTax's biggest competitor?” Multiple hands shot up. At the time, the other major tax preparation software in the market was TaxCut by H&R Block. After someone confidently answered, “TaxCut,” Scott surprised us all by saying that the biggest competitor to TurboTax was actually pen and paper. He pointed out that, at the time, more Americans were still preparing their taxes by hand using IRS forms than all tax software combined.

This example highlights another advantage of clear problem space thinking: having a more accurate understanding of the market in which your product is really competing. Those of us in the audience were narrowly thinking in solution space of the “tax preparation software” market, as defined by the two main software products. Scott was thinking in problem space of the broader “tax preparation” market—one that would also include tax accountants to whom customers delegate their tax preparation. As the previous chapter discusses, a market is a set of related customer needs, which rests squarely in problem space. A market is not tied to any specific solutions that meet those needs. That is why you see “market disruptions”: when a new type of product (solution space) better meets the market needs (problem space). New technology can often enable a market disruption to deliver similar benefits at a much lower cost. Voice-over-Internet-Protocol (VOIP) is a great example of a disruptive technology that has replaced traditional telephone service. At first, the sound quality of VOIP calls couldn't compare to that of traditional phone lines, but the cost was so much lower that it offered a superior solution for much of the telephone market.

The What and the How

As a product manager at Intuit, I learned to write detailed product requirements that stayed in the problem space without getting into the solution space. We were trained to first focus on “what” the product needed to accomplish for customers before getting into “how” the product would accomplish it. You often hear strong product teams distinguishing between the “what” versus the “how.” The “what” describes the benefits that the product should give the customer—what the product will accomplish for the user or allow the user to accomplish. The “how” is the way in which the product delivers the “what” to the customer. The “how” is the design of the product and the specific technology used to implement the product. “What” is problem space and “how” is solution space.

Outside-In Product Development

A failure to gain a clear understanding of the problem space before proceeding to the solution space is prevalent in companies and teams that practice “inside-out” product development, where “inside” refers to the company and “outside” refers to customers and the market. In such teams, the genesis of product ideas is what one or more employees think would be good to build. They don't test the ideas with customers to verify if the product would solve actual customer needs. The best way to mitigate the risk of an “inside-out” mindset is to ensure your team is talking with customers. That's why Steve Blank urges product teams to “get out of the building” (GOOB for short).

In contrast, “outside-in” product development starts with an understanding of the customer's problem space. By talking with customers to understand their needs, as well as what they like and don't like about existing solutions, outside-in product teams can form a robust problem-space definition before starting product design. Lean product teams articulate the hypotheses they have made and solicit customer feedback on early design ideas to test those hypotheses. This approach is the essence of Lean—and was actually first advocated for years ago by practitioners of user-centered design.

Should You Listen to Customers?

Some people criticize user-centered design by saying that talking with users will not lead you to come up with new, breakthrough solutions. Those critics like to quote Henry Ford, who famously said: “If I had asked people what they wanted, they would have said a faster horse.” They also like to point out the example of Steve Jobs and how Apple has launched many successful products using what seems to be a very “inside-out” product development process. In fact, Steve Jobs cited the same Henry Ford quote in a 2008 interview with Forbes.

It is true that customers are not likely to identify the next breakthrough solution in your product category. But why would anyone expect them to? They are not product designers, product managers, or technologists. The fallacious thinking comes in when people use this argument to rationalize why it's not important to talk with customers or to understand their needs and preferences. Most people who make that argument are really using it as an excuse to not talk with customers because they want to adopt an “inside-out” philosophy. They think that they have all the answers and that talking with customers is a waste of time. They don't understand problem space versus solution space.

It's likely true that customers won't invent a breakthrough product for you; but that doesn't mean it's a waste of time to understand their needs and preferences. On the contrary, a good understanding of customer needs and preferences helps product teams explore new potential solutions and estimate how valuable customers are likely to find each one to be.

Critics of user-centered design like to justify their views by saying, “Apple doesn't talk to customers.” At Apple's 1997 Worldwide Developers Conference, Steve Jobs shared a more enlightened perspective that is consistent with the Lean Product Process when he said:

You've got to start with the customer experience and work backwards to the technology. You can't start with the technology and try to figure out where you're going to try to sell it.… As we have tried to come up with a strategy and a vision for Apple, it started with: What incredible benefits can we give to the customer? …Not starting with: Let's sit down with the engineers and figure out what awesome technology we have and then how we're going to market that. And I think that's the right path to take.

A Tale of Two Apple Features

Even though Apple does indeed have a reputation for not soliciting customer feedback on products before they're launched, a large part of why their products are so successful is because, despite that, they have an in-depth understanding of customer needs. Consider the Touch ID fingerprint sensor that Apple introduced with the iPhone 5S. Touch ID utilizes advanced technology: the high-resolution sensor is only 170 microns thick and captures 500 dots per inch. The button is made of sapphire crystal—one of the clearest, hardest materials available—to protect the sensor. The button also acts as a lens to precisely focus the sensor on the user's finger. Touch ID maps out individual details in the ridges of fingerprints that are smaller than the human eye can see and can recognize multiple fingerprints in any orientation.

It's unlikely that any iPhone customer would have come up with such a solution. I would guess that Apple didn't test the solution with many customers before launching it. Despite that, I argue that the iPhone team had a good understanding of the problem space and could be confident that customers would consider Touch ID valuable. Touch ID offered a new alternative to the traditional way of unlocking your iPhone and logging in to the App Store to make a purchase. Touch ID is better because what matters to customers when they're authenticating is how convenient and how secure it is. Usually, there is a tension between those two customer benefits, with more convenient authentication mechanisms being less secure (and vice versa).

Most iPhone users will tell you that they unlock their phones quite frequently, often multiple times per day. Because people value their time, reducing the time it takes to unlock is a clear benefit. iPhone users value security, too. They don't want unauthorized people to be able to access their phone, especially if it is lost or stolen. With a four-digit passcode, the odds of someone guessing your passcode are 1 in 10,000. According to Apple, the odds that two fingerprints are similar enough for Touch ID to consider them the same is 1 in 50,000 (and it's much harder to try different fingers than it is to type in different numbers).

Touch ID makes authenticating much quicker than having to enter an unlock passcode or App Store password. It's also more convenient because users no longer have to worry about forgetting these passcodes.

Because Touch ID clearly saves time, is more convenient, and is more secure than the previous solution, the iPhone team could be confident that customers would consider the feature valuable, even without explicitly validating it with them. However, if Apple didn't test Touch ID with customers, it still ran the risk of some unforeseen negative consequence. It's worth pointing out that Apple does test their products internally with their employees (who are often a good proxy for customers). This internal testing tactic where you use your own product is called “dogfooding.”

That being said, Apple isn't perfect. For example, customers were not happy with a product “improvement” that Apple made with the power button on the 2013 MacBook Pro. In the prior version of the laptop, the power button was located away from the keyboard keys, was smaller, had a different color, and was inset, all of which made it difficult to press by accident. When users pressed the button in the prior version, a dialog window would appear, providing options to restart, sleep, or shut down their laptop, along with the option to cancel any action. But Apple decided to change the power button design for the 2013 version: they made it look like the other keys and incorporated it into the keyboard (in the upper right, where the eject key used to be). The new power button was placed right next to the “delete” key as well as the key that increases the sound volume, both of which are used frequently. As a result, users started accidentally pressing the power button (and then had to click the cancel button).

To add insult to injury, Apple's subsequent operating system update—OS X Mavericks—changed the behavior of the power button. When the power button is pressed in Mavericks, you no longer get the dialog window with its various choices; instead your computer goes right to sleep. The combined effect of those two changes (moving the power button and changing its behavior) resulted in frustrated users whose laptops would suddenly go to sleep unexpectedly. Usability issues such as this are easy to identify through customer testing—even with a small number of testers.

Let's compare these two Apple examples. In the case of the Touch ID, there were clear benefits and no unforeseen risks arose. In the case of the power button changes, what were the intended customer benefits? It's unclear what they were. Perhaps the new power button design addressed internal company objectives related to aesthetics or reduced cost. Regardless, the button's new design and behavior resulted in dissatisfaction for customers. It's true that customers aren't going to lead you to the Promised Land of a breakthrough innovative product, but customer feedback is like a flashlight in the night: it keeps you from falling off a cliff as you try to find your way there.

Using the Solution Space to Discover the Problem Space

Customers are also not likely to serve you their problem space needs on a silver platter. It's hard for them to talk about abstract benefits and the relative importance of each—and when they do, it's often fraught with inaccuracies. It's therefore the product team's job to unearth these needs and define the problem space. One way is to interview customers and observe them using existing products. Such techniques are called “contextual inquiry” or “customer discovery.” You can observe what pain points they run into even if they don't explicitly mention them to you. You can ask them what they like and don't like about the current solutions. As you form hypotheses about the customer needs and their relative importance, you can validate and improve your hypotheses using these techniques.

The reality is that customers are much better at giving you feedback in the solution space. If you show them a new product or design, they can tell you what they like and don't like. They can compare it to other solutions and identify pros and cons. Having solution space discussions with customers is much more fruitful than trying to explicitly discuss the problem space with them. The feedback you gather in the solution space actually helps you test and improve your problem space hypotheses. The best problem space learning often comes from feedback you receive from customers on the solution space artifacts you have created.

Problem space and solution space are an integral part of the Product-Market Fit Pyramid, as shown in Figure 2.1. Your product's feature set and UX live in solution space—they're what customers can see and react to. The other three layers of the pyramid live in problem space. The important interface between problem space and solution space occurs between your value proposition and your feature set. It is, of course, within your control to change your feature set and UX as you like. Unlike customers and their needs, which you can target but can't change, value proposition is the problem space layer over which you have the most control.

Figure 2.1 Problem Space versus Solution Space

As Dave McClure of 500 Startups said, “Customers don't care about your solution. They care about their problems.” Keeping problem space and solution space separate and alternating between them as you iteratively test and improve your hypotheses is the best way to achieve product-market fit. The Lean Product Process gives you step-by-step guidance on how to do that. Let's jump into the first step of the process: identifying your target customer.